| Fee paid previously with preliminary materials. | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule | ||||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: | |||

Mail Stop J09N05

Minneapolis, Minnesota 55402

612303-6000

March 16, 2009

Dear Shareholders:

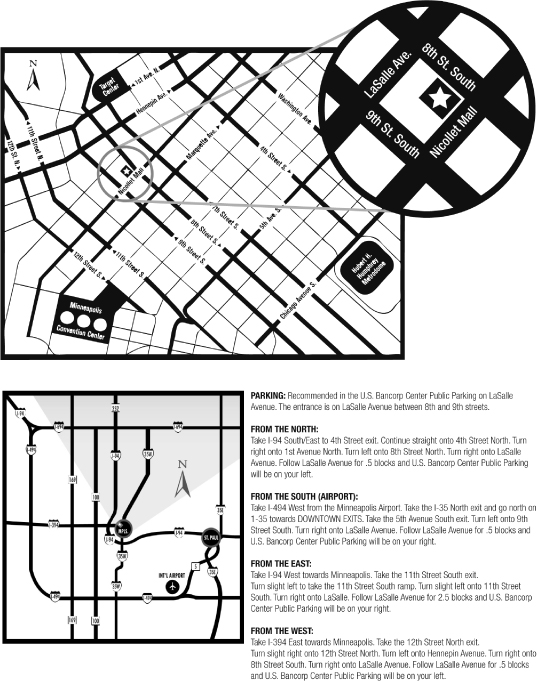

You are cordially invited to join us for our 20092012 annual meeting of shareholders, which will be held on Thursday,Wednesday, May 7, 2009,9, 2012, at 3:2:30 p.m., Central Time, in the Huber Room on the 12th floor of our Minneapolis headquarters in the U.S. Bancorp Center, 800 Nicollet Mall, Minneapolis, Minnesota. The Notice of Annual Meeting of Shareholders and the proxy statement that follow describe the business to be conducted at the meeting.

We are furnishing our proxy materials to you over the Internet, which will reduce our costs and the environmental impact of our annual meeting. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials to you, which contains instructions on how to access our proxy statement and annual report and vote online. The Notice of Availability also contains instructions on how to request a printed set of proxy materials.

Whether or not you plan to attend the meeting, your vote is important and we encourage you to vote your shares promptly. You may vote your shares using a toll-free telephone number or the Internet. If you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. Instructions regarding the three methods of voting are contained on the Notice of Availability and the proxy card.

We look forward to seeing you at the annual meeting.

| Sincerely, |

|

| ANDREW S. DUFF |

| Chairman and Chief Executive Officer |

Mail Stop J09N05

Minneapolis, Minnesota 55402

612303-6000

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | |||

| Date and Time: | |||

| Place: | The Huber Room in our Minneapolis Headquarters 12th Floor, U.S. Bancorp Center 800 Nicollet Mall Minneapolis, MN 55402 | ||

| Items of Business: | 1. The election of | ||

2. Ratification of the selection of Ernst & Young LLP as the independent auditor of Piper Jaffray Companies for the fiscal year ending December 31, 2012. | |||

3. An advisory vote to approve the compensation of the officers disclosed in the attached proxy statement, or a “say-on-pay” vote. | |||

4. Any other business that may properly be considered at the meeting or any adjournment or postponement of the meeting. | |||

| Record Date: | You may vote at the meeting if you were a shareholder of record at the close of business on March | ||

| Voting by Proxy: | Whether or not you plan to attend the annual meeting, please vote your shares by proxy to ensure they are represented at the meeting. You may submit your proxy vote by telephone or Internet, as described in the Notice of Internet Availability of Proxy Materials and the following proxy statement, by no later than 11:59 p.m. Eastern Daylight Time on | ||

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting to be held on May 7, 20099, 2012

Our proxy statement and 20082011 annual report are available at www.piperjaffray.com/proxymaterials

| By Order of the Board of Directors |

|

| JAMES L. CHOSY |

| Secretary |

March 16, 2009

23, 2012

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

How do I vote if I hold shares in the Piper Jaffray Companies Retirement Plan or U.S. | 3 | |||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

i

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 |

i

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

| 46 |

ii

20092012 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 7, 20099, 2012

The Board of Directors of Piper Jaffray Companies is soliciting proxies for use at the annual meeting of shareholders to be held on May 7, 2009,9, 2012, and at any adjournment or postponement of the meeting. Notice of Internet Availability of Proxy Materials, which contains instructions on how to access this proxy statement and our annual report online, is first being mailed to shareholders on or about March 16, 2009.

At our annual meeting, shareholders will act upon the matters outlined in the Notice of Annual Meeting of Shareholders, and management will report on matters of current interest to our shareholders and respond to questions from our shareholders. The matters outlined in the notice include the election of directors, and the approvalratification of an amendment to our Amended and Restated 2003 Annual and Long-Term Incentive Plan (the “Incentive Plan”), which is being amended principally to increase the number of sharesselection of our common stock availableindependent auditor for issuance under2012 and an advisory vote to approve the Incentive Plan by 1,500,000 shares.With respect to the Incentive Plan proposal, the Boardcompensation of Directors believes thatour officers disclosed in this proposal is critical to Piper Jaffray’s future success. The increase in shares will allow us to strengthen our employee ownership culture and further align employees’ interests with the interests of shareholders. The Board of Directors recommends that you vote for approval of this increase in available shares under the plan.

The Board has set March 10, 2009,14, 2012 as the record date for the annual meeting. If you were a shareholder of record at the close of business on March 10, 2009,14, 2012, you are entitled to vote at the meeting. As of the record date, 19,669,60119,034,787 shares of common stock, representing all of our voting stock, were issued and outstanding and, therefore, eligible to vote at the meeting.

Holders of our common stock are entitled to one vote per share. Therefore, a total of 19,669,60119,034,787 votes are entitled to be cast at the meeting. There is no cumulative voting.

In accordance with our bylaws, shares equal to a majority of the voting power of the outstanding shares of common stock entitled to vote generally in the election of directors as of the record date must be present at the annual meeting in order to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if: you are present and vote in person at the meeting; or you have properly and timely submitted your proxy as described below under “How do I submit my proxy?” It is your designation of another person to vote stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. When you designate a proxy, you also may direct the proxy how to vote your shares. We• you are present and vote in person at the meeting; or• you have properly and timely submitted your proxy as described below under “How do I submit my proxy?”

It is a document that we are required to make available to you by Internet or, if you request, by mail in accordance with regulations of the Securities and Exchange Commission, when we ask you to designate proxies to vote your shares of Piper Jaffray Companies common stock at a meeting of our shareholders. The proxy statement includes information regarding the matters to be acted upon at the meeting and certain other information required by regulations of the Securities and Exchange Commission and rules of the New York Stock Exchange.

As permitted by Securities and Exchange Commission rules, we have elected to provide access to our proxy materials over the Internet, which in the mail this year instead of a full set of proxy materials?will reducereduces our costs and the environmental impact of our annual meeting. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners.owners who have not previously requested a printed set of proxy materials. The Notice of Availability contains instructions on how to access our proxy statement and annual report and vote online, as well as instructions on how to request a printed set of proxy materials.

To get electronic access to the proxy materials, you will need your control number, which was provided to you in the Notice of Internet Availability of Proxy You will need your control number toMaterials.Materials or the proxy card included in your printed set of proxy materials. Once you have your control number, you may either go towww.proxyvote.comand enter your control number when prompted, or send ane-mail requesting electronic delivery of the materials tosendmaterial@proxyvote.com.

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the shareholder of record with respect to those shares, while you are considered the beneficial owner of those shares. In that case, your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the method described below under “How do I submit my proxy?”

If you are a shareholder of record, you can submit a proxy to be voted at the meeting in any of the following ways:

| • | ||

through the Internet usingwww.proxyvote.com; | ||

over the telephone by calling a toll-free number; or

if you receive a paper copy of the proxy card after requesting the proxy materials by mail, you may sign, date and mail the proxy card.

To vote by telephoneInternet or Internet,telephone, you will need to use a control number that was provided to you by our vote tabulator, Broadridge Financial Solutions, and then follow the additional proceduressteps when prompted. The proceduressteps have been designed to authenticate your identity, allow you to give voting instructions, and

confirm that those instructions have been recorded properly. If you hold your shares in street name, you must vote your shares in the manner prescribed by your broker, bank, trust or other nominee, which is similar to the voting procedures for shareholders of record. However, if you request

2

If you hold shares of Piper Jaffray common stock in the Piper Jaffray Companies Retirement Plan or U.S. BancorpBank 401(k) Savings Plan?BancorpBank 401(k) Savings Plan, the submission of your proxy by Internet or telephone or your completed proxy card will serve as voting instructions to the respective plan’s trustee. Your voting instructions must be received at least five days prior to the annual meeting in order to count. In accordance with the terms of the Piper Jaffray Companies Retirement Plan and U.S. BancorpBank 401(k) Savings Plan, the trustee of each plan will vote all of the shares held in the plan in the same proportion as the actual proxy votes submitted by plan participants at least five days prior to the annual meeting.

If you receive more than one Notice of Internet Availability of Proxy Materials or printed set of proxy materials, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, vote once for each control number you receive as described above under “How do I submit my proxy?”Materials?Materials or printed set of proxy materials?.

If you are a shareholder of record, you may vote your shares in person at the meeting by completing a ballot at the meeting. Even if you currently plan to attend the meeting, we recommend that you submit your proxy as described above so your vote will be counted if you later decide not to attend the meeting. If you submit your vote by proxy and later decide to vote in person at the annual meeting, the vote you submit at the meeting will override your proxy vote. If you are a street name holder, you may vote your shares in person at the meeting only if you obtain and bring to the meeting a signed letter or other form of proxy from your broker, bank, trust or other nominee giving you the right to vote the shares at the meeting. If you are a participant in the Piper Jaffray Companies Retirement Plan or U.S. BancorpBank 401(k) Savings Plan, you may submit voting instructions as described above, but you may not vote your Piper Jaffray shares held in the Piper Jaffray Companies Retirement Plan or U.S. BancorpBank 401(k) Savings Plan in person at the meeting.

The Board of Directors recommends a vote: FOR all of the nominees for director; FORthe ratification of the selection of Ernst & Young LLP as the independent auditor of Piper Jaffray Companies for the year ending December 31, 2012; and FORthe advisory approval of the compensation of our officers included in this proxy statement. If you are a shareholder of record and submit a signed proxy card or submit your proxy by Internet or telephone but do not specify how you want to vote your shares on a particular matter, we will vote your shares as follows: Your vote is important. We urge you to vote, or to instruct your broker, bank, trust or other nominee how to vote, on all matters before the annual meeting.If you are a street name holder and fail to instruct the shareholder of record how you want to vote your shares on a particular matter, those shares are considered to be “uninstructed.” New York Stock Exchange rules determine the circumstances under which member brokers of the New York Stock Exchange may exercise discretion to vote “uninstructed” shares held by them on behalf of their clients who are street name holders. Other than the ratification of the selection of Ernst & Young LLP as our independent auditor for the year ending December 31, 2012, the rules donotpermit member brokers to exercise voting discretion as to the uninstructed shares on any matter included in the notice of meeting. With respect to the Our broker-dealer subsidiary, Piper Jaffray & Co., is a member broker of the New York Stock Exchange and may be a shareholder of record with respect to shares of our common stock held in street name on behalf of Piper Jaffray & Co. clients. Because Piper Jaffray & Co. is our affiliate, New York Stock Exchange rules prohibit Piper Jaffray & Co. from voting uninstructed shares even on routine matters. Instead, Piper Jaffray & Co. may vote uninstructed shares on such matters only in the same proportion as the shares represented by the votes cast by all shareholders of record with respect to such matters. Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the annual meeting, in any of the following ways: by submitting a later-dated proxy by Internet or telephone before 11:59 p.m. Eastern Daylight Time on Tuesday, May 8, 2012; by submitting a later-dated proxy to the corporate secretary of Piper Jaffray Companies, which must be received by us before the time of the annual meeting; by sending a written notice of revocation to the corporate secretary of Piper Jaffray Companies, which must be received by us before the time of the annual meeting; or by voting in person at the meeting. The The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting is required to If the The advisory vote on the compensation of our executives is not binding on us or the Board, but we will consider the shareholders’ advisory input on this matter when establishing compensation for our executive officers in future years. You may either vote “FOR” or “WITHHOLD” authority to vote for each director nominee. You may vote “FOR,” “AGAINST” or “ABSTAIN” on ratification of the If you withhold authority to vote for one or more of the director nominees or you do not vote your shares on this matter (whether by broker non-vote or otherwise), this will have no effect on the outcome of the vote. With respect to the proposal to All of our shareholders are invited to attend the annual meeting. You may be asked to present valid photo identification, such as a driver’s license or passport, before being admitted to the meeting. If you hold your shares in street name, you also may be asked to present proof of ownership to be admitted to the meeting. A brokerage statement or letter from your broker, bank, trust or other nominee are examples of proof of ownership. To help us plan for the meeting, please let us know whether you expect to attend, by responding affirmatively when prompted during Internet or telephone voting or by marking the attendance box on the proxy card. Piper Jaffray pays for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or other nominees for forwarding proxy materials to street name holders. We have retained Innisfree M&A Incorporated to assist in the solicitation of proxies for the annual meeting for a fee of approximately The number of directors currently serving on our Board of Directors is Andrew S. Duff, Michael R. Francis, B. Kristine Johnson, Addison L. Piper, Lisa K. Polsky, Following is biographical information for each of the nominees for election as a ANDREW S. DUFF: Age 54, chairman and MICHAEL R. FRANCIS: Age B. KRISTINE JOHNSON:Age as a consultant to Affinity Capital Management in 1999. Prior to that, she was employed for 17 years at Medtronic, Inc., a manufacturer of cardiac pacemakers, neurological and spinal devices and other medical products, serving most recently as senior vice president and chief administrative officer from 1998 to 1999. Her experience at Medtronic also included service as president of the vascular business and president of the tachyarrhythmia management business, among other roles. ADDISON L. PIPER: Age LISA K. POLSKY: Age FRANK L. SIMS: Age JEAN M. TAYLOR: Age 49, director since July 27, 2005. Ms. Taylor is president of Life is Now, Inc., a strategy and consulting firm that she founded in October 2011. She was affiliated with Performance Unlimited, also a consulting firm, from the founding of Life is Now through January 2012. Previously, Ms. Taylor served as the president and chief executive officer of Taylor Corporation, having served as chief executive officer from 2007 until July 2010. Taylor Corporation is a privately held group of approximately 80 affiliated entrepreneurial companies engaged in marketing, fulfillment, personalization and printing services. Ms. Taylor joined Taylor Corporation in 1994. MICHELE VOLPI: Age 48, director since February 3, 2010. Since October 2011, Mr. Volpi has served as the chief executive officer of Betafence, a global provider of fencing solutions. Prior to joining Betafence, Mr. Volpi served as the president and chief executive officer and as a director of H.B. Fuller Company from December 2006 to November 2010. H.B. Fuller and its subsidiaries manufacture and market adhesives and specialty chemical products worldwide. Prior to becoming president and chief executive officer, he was group president, general manager of the global adhesives division of H.B. Fuller from December 2004 to December 2006. Mr. Volpi also served as global strategic business unit manager, assembly for H.B. Fuller from June 2002 to December 2004. From 1999 to June 2002, Mr. Volpi served as general manager, marketing for General Electric Company. He currently serves as a member of the board of directors of Saipem, S.p.A. HOPE B. WOODHOUSE: Age 55, director since September 22, 2011. Ms. Woodhouse most recently served as the chief operating officer of Bridgewater Associates, LP, a large investment advisory firm, a position she held from 2005 to 2008. Prior to that, Ms. Woodhouse served as the president and chief operating officer of Auspex Group, L.P., a global macro hedge fund, and as the chief operating officer of Soros Fund Management LLC, a privately owned hedge fund sponsor. Ms. Woodhouse also held a variety of positions at Salomon Brothers Inc. from 1983 to 1998, including serving as managing director of the global finance department from 1997 to 1998. Each nominee brings unique capabilities to the Board. The Board believes the nominees as a group have the experience and skills in areas such as general business management, corporate governance, leadership development, investment banking, finance and risk management that are necessary to effectively oversee our company. In addition, the Board believes that each of our directors possesses high standards of ethics, integrity and professionalism, sound judgment, community leadership and a commitment to representing the long-term interests of our shareholders. The following is information as to why each nominee should serve as a director of our company: Mr. Duff has been our chairman and chief executive officer since our spin-off from U.S. Bancorp in 2003, and has more than 30 years of experience in the capital markets industry with Piper Jaffray. The Board believes he has the knowledge of our company and its business necessary to help formulate and execute our business plans and growth strategies. Mr. Francis provides the Board with extensive marketing knowledge and expertise from his more than 25 years in the retail industry, including his service as president of J.C. Penney Company, Inc., and as chief marketing officer for Target Corporation. Also, Mr. Francis’ current role with J.C. Penney as well as his service as an executive officer of Target, provide him with significant management experience that is valuable to the Board and our management. Mr. Francis also has prior experience as a public company director. Ms. Johnson has extensive experience in both the health care industry and the venture capital business, with the health care industry being one of our primary areas of focus. She has served as president of a venture capital firm investing in health care companies and as a senior officer in various roles at Medtronic, a global leader in medical technology and a Minnesota-based public company. Her deep ties to the health care industry and the venture capital business provide the Board with valuable insights and knowledge, both from a client and public company perspective. Ms. Johnson also has prior experience as a public company director in the telecommunications and industrial manufacturing industries. Mr. Piper has been a part of our company since 1969, serving in many roles, including chief executive officer from 1983 to 2000 and vice chairman following our spin-off from U.S. Bancorp until his retirement. His experience with the company provides deep institutional knowledge as well as a comprehensive understanding of the financial services industry. Mr. Piper also has experience as a public company director, having served on the board of directors of Renaissance Learning, an education software company, from July 2001 until its sale in October 2011. Ms. Polsky has extensive experience in the financial services industry, having served as a managing director at both Morgan Stanley and Merrill Lynch. Ms. Polsky currently serves as chief risk officer of CIT Group, a position she previously held at Morgan Stanley, providing valuable experience and insights relating to risk management, an important discipline for a securities firm such as our company. Ms. Polsky’s significant financial experience caused the Board to determine that she is an audit committee financial expert under applicable rules of the Securities and Exchange Commission. Ms. Polsky also has experience as a public company director, having served on the board of directors of thinkorswim Group Inc., an online brokerage specializing in options, from 2007 until its sale to TD Ameritrade in June 2009. Mr. Sims has significant management, financial, and risk management knowledge and experience gained from his role as a senior executive of Cargill, a large, diversified, international company. He has served as chairman of the Federal Reserve Bank of Minneapolis and has current and prior experience as a public company director. His leadership experience as an executive of one of the country’s largest private companies and his considerable experience in oversight roles as a director, provides valuable experience, insight and judgment to the Board. The Board also determined that Mr. Sims is an audit committee financial expert under applicable rules of the Securities and Exchange Commission. Ms. Taylor has extensive management and financial experience from her service as president and chief executive officer of Taylor Corporation, one of the largest privately held companies in the United States. She also has a thorough understanding of strategy, leadership development and employee relations, which has benefited the Board and management in shaping the company’s culture. Mr. Volpi has significant international management experience, currently serving as chief executive officer of Betafence, a global provider of fencing solutions located in Belgium, and previously serving as the president and chief executive officer and a director of H.B. Fuller Company, a large, global public company based in Minnesota. His international experience and extensive management skills provide valuable perspective and insight to our management and to the Board. Ms. Woodhouse has more than 25 years of experience in the financial services industry, most recently serving as chief operating officer of Bridgewater Associates, LP, a large global hedge fund. Her deep experience at leading, global alternative asset management firms and broker-dealers provides the Board valuable perspectives on the Company’s operations and also strategic decisions. Ms. Woodhouse’s significant financial experience caused the Board to determine that she is an audit committee financial expert under applicable rules of the Securities and Exchange Commission. The Board of Directors conducts its business through meetings of the Board and the following standing committees: Audit, Compensation, and Nominating and Governance. Each of the standing committees has adopted and operates under a written charter, and, annually in November, each committee reviews its charter, performs a self-evaluation and establishes a plan for committee activity for the upcoming year. The committee charters are all We have adopted a Code of Ethics and Business Conduct applicable to our employees, including our principal executive officer, principal financial officer, principal accounting officer, controller and other employees performing similar functions, and a separate Code of Ethics and Business Conduct applicable to our directors. Directors who also serve as officers of Piper Jaffray must comply with both codes. Both codes are available on our website atwww.piperjaffray.com Under applicable rules of the New York Stock Exchange, a majority of the members of our Board of Directors must be independent, and no director qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with Piper Jaffray. To assist the Board with these determinations, the Board has adopted Mr. Duff Board Leadership Structure and Since our spin-off from U.S. Bancorp, Mr. Duff has served in the combined roles of presides at all meetings of the Board at which the chairman is not present, including executive sessions of the independent directors, and coordinates the agenda for and moderates these executive sessions; serves formally as a liaison between the chief executive officer and the independent directors; monitors Board meeting schedules and agendas to ensure that appropriate matters are covered and that there is sufficient time for discussion of all agenda items; monitors information sent to the Board and advises the chairman as to the quality, quantity and timeliness of the flow of information; has authority to call meetings of the independent directors; and if requested by major shareholders, makes himself available for consultation and direct communication. We believe that Mr. Duff’s combined service as chairman and chief executive officer creates unified leadership for the Board and the company, with one cohesive vision for our organization. This leadership structure, which is common among U.S.-based publicly traded companies, demonstrates to our clients, employees and shareholders that the company is under strong leadership. As chairman and chief executive officer, Mr. Duff helps shape the strategy ultimately set by the entire Board and also leverages his operational experience to balance growth and risk management. We believe the oversight provided by the Board’s independent directors, the work of the Board’s committees described below and the coordination between the chief executive officer and the independent directors conducted by the lead director help provide effective oversight of our company’s strategic plans and operations. We believe having one person serve as chairman and chief executive officer is in the best interests of our company and our shareholders at this time. Board Involvement in Risk Oversight At both the Board and committee levels, our non-employee directors meet regularly in executive sessions in which Mr. Duff and other members of management do not participate. Mr. We have three standing committees of the Board: the Audit Committee, Director Michael R. Francis B. Kristine Johnson Lisa K. Polsky Frank L. Sims Jean M. Taylor Michele Volpi Hope B. Woodhouse Effective May 9, 2012, Ms. Taylor will join the Audit Committee and Compensation Committee, Ms. Woodhouse will join the Compensation Committee, and Mr. Sims will transition off of the Compensation Committee. The Audit Committee’s purpose is to oversee the integrity of our financial statements, the independent auditor’s qualifications and independence, the performance of our internal audit function and independent auditor, and compliance with legal and regulatory requirements. The Audit Committee has sole authority to retain and terminate the independent auditor and is directly responsible for the compensation and oversight of the work of the independent auditor. As discussed above, the Audit Committee is primarily responsible for monitoring management’s responsibility in the area of risk oversight. The Audit Committee also meets with management and the independent auditor to review and discuss the annual audited and quarterly unaudited financial statements, reviews the integrity of our accounting and financial reporting processes and audits of our financial statements, and prepares the Audit Committee Report included in the proxy statement. The responsibilities of the Audit Committee are more fully described in the Committee’s charter. The Audit Committee met eight times during The Compensation Committee discharges the Board’s responsibilities relating to compensation of the executive officers, oversees succession planning for the executive officers jointly with the Nominating and Governance Committee and ensures that our compensation and employee benefit programs are aligned with our compensation and benefits philosophy. These responsibilities also include reviewing and discussing with management whether the company’s compensation arrangements are consistent with effective controls and sound risk management. The Committee has full discretion to determine the amount of compensation to be paid to the executive officers. The Committee also has sole authority to evaluate the chief executive officer’s performance and determine the compensation of the chief executive officer based on this evaluation. guidelines for the executive officers and directors, for recommending the compensation and benefits to be provided to our non-employee directors, for reviewing and approving the establishment of broad-based incentive compensation, equity-based, retirement or other material employee benefit plans, and for discharging any duties under the terms of these plans. The Committee has delegated authority to our chief executive officer under The work of the Committee is supported by our human capital department, primarily through our global head of human capital, as well as by our finance department, primarily through our chief The Compensation Committee has engaged an independent outside compensation consultant, The Compensation Committee reviews and discusses with management the disclosures regarding executive compensation to be included in our annual proxy statement, and recommends to the Board inclusion of the Compensation Discussion and Analysis in our annual proxy statement. The responsibilities of the Compensation Committee are more fully described in the Committee’s charter. For more information regarding the Committee’s process in setting compensation, please see “Compensation Discussion and Analysis — Setting Compensation” below. The Compensation Committee met The Nominating and Governance Committee identifies and recommends individuals qualified to become members of the Board of Directors and recommends to the Board sound corporate governance principles and practices for Piper Jaffray. In particular, the Committee assesses the independence of our Board members, identifies and evaluates candidates for nomination as directors, responds to director nominations submitted by shareholders, recommends the slate of director nominees for election at the annual meeting of shareholders and candidates to fill vacancies between annual meetings, recommends qualified members of the Board for membership on committees, oversees the director orientation and continuing education programs, reviews the Board’s committee structure, reviews and assesses the adequacy of our Corporate Governance Principles, executive officer, the Board and Board committees, and oversees the succession planning process for the executive officers jointly with the Compensation Committee. The Nominating and Governance Committee also oversees administration of our related person transaction policy and reviews the transactions submitted to it pursuant to such policy. The responsibilities of the Nominating and Governance Committee are more fully described in the Committee’s charter. The Nominating and Governance Our Corporate Governance Principles provide that our directors are expected to attend meetings of the Board and of the committees on which they serve, as well as our annual meeting of shareholders. Our Board of Directors held The Board has established a process for shareholders and other interested parties to send written communications to the Board or to individual directors. Such communications should be sent by U.S. mail to the attention of the Office of the Secretary, Piper Jaffray Companies, 800 Nicollet Mall, Suite 800, Mail Stop The Nominating and Governance Committee will consider director candidates recommended by shareholders and has adopted a policy that contemplates shareholders recommending and nominating director candidates. A shareholder who wishes to recommend a director candidate for nomination by the Board at the annual meeting of shareholders or for vacancies on the Board that arise between shareholder meetings must timely provide the Nominating and Governance Committee with sufficient written documentation to permit a determination by the Board whether such candidate meets the required and desired director selection criteria set forth in our bylaws, our Corporate Governance Principles and our Director Nominee Selection Policy described below. Such documentation and the name of the director candidate must be sent by U.S. mail to the Chairperson, Nominating and Governance Committee,c/o the Office of the Secretary, Piper Jaffray Companies, 800 Nicollet Mall, Suite 800, Mail Stop Alternatively, shareholders may directly nominate a person for election to our Board by complying with the procedures set forth in Article II, Section 2.4 of our bylaws, and with the rules and regulations of the Securities and Exchange Commission. Under our bylaws, only persons nominated in accordance with the procedures set forth in the bylaws will be eligible to serve as directors. In order to nominate a candidate for service as a director, you must be a shareholder at the time you give the Board notice of your nomination, and you must be entitled to vote for the election of directors at the meeting at which your nominee will be considered. In accordance with our bylaws, director nominations generally must be made pursuant to notice delivered to, or mailed and received at, our principal executive offices at the address above, not later than the 90th day, nor earlier than the 120th day, prior to the first anniversary of the prior year’s annual meeting of shareholders. Your notice must set forth all information relating to the nominee that is required to be disclosed in solicitations of proxies for the election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including the nominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected). During 2011, non-employee directors received a $60,000 annual cash retainer Our non-employee directors may participate in the Piper Jaffray Companies Deferred Compensation Plan for Non-Employee Directors, which was designed to facilitate increased equity ownership in the market value of the stock on the last day of the year in which the director’s service with us terminates. Share amounts that have been deferred will be paid out to the director (or, in the event of the director’s death, to his or her beneficiary) in the form of shares of common stock in an amount equal to the full number of shares credited to the non-employee director’s account as of the last day of the year in which the cessation of service occurred. Directors who elect to participate in the plan are not required to pay income taxes on amounts or grants deferred but will instead pay income taxes on the amount of the lump-sum cash payment paid to the director (or beneficiary) at the time of such payment. Our obligations under the plan are unsecured general obligations to pay in the future the value of the participant’s account pursuant to the terms of the plan. Non-employee directors The following table contains compensation information for our non-employee directors for the year ended December 31, Director Michael R. Francis Virginia Gambale B. Kristine Johnson Addison L. Piper Lisa K. Polsky Frank L. Sims Jean M. Taylor Michele Volpi Hope B. Woodhouse Represents the As of December 31, Director Michael R. Francis Virginia Gambale B. Kristine Johnson Addison L. Piper Lisa K. Polsky Frank L. Sims Jean M. Taylor Michele Volpi Hope B. Woodhouse All other compensation for non-employee directors for the year ended December 31, The amounts for Ms. Johnson, Mr. Piper, Ms. Polsky, Mr. Sims, Ms. Taylor, Mr. Volpi and The These amounts were deferred pursuant to the Piper Jaffray Companies Deferred Compensation Plan for Non-Employee Directors. Reflects a pro rata portion of the Reflects a pro rata portion of the Reflects a pro rata portion of the full additional cash retainer for the portion of the year Mr. Volpi served as chairperson of the Compensation Committee (February 3, 2011 — December 31, 2011). Reflects a pro rata portion of the full annual cash retainer for the portion of the year Ms. Woodhouse served on the Board (September 22, 2011 — December 31, 2011). Includes Ms. Woodhouse’s initial equity grant of $60,000 for joining the Board of Directors (3,279 shares issued on September 22, 2011 using the closing price of our common stock on that day of $18.30 per share) as well as the pro rata portion of her annual equity grant equal to $16,603 for the portion of the year Ms. Woodhouse served on the Board (September 22, 2011 — December 31, 2011). COMPENSATION DISCUSSION AND ANALYSIS Executive Summary 2011 Financial Performance 2011 represented a volatile year filled with macroeconomic challenges. During the second half of 2011, the escalation of the sovereign debt crisis in Europe, the credit rating downgrade by S&P of U.S. debt, and Against this challenging operating environment, we achieved positive pre-tax earnings in each quarter on a non-GAAP basis (excluding a goodwill impairment charge described in the next paragraph), in part due to reduced incentive compensation commensurate with our performance for both executive officers and employees generally. Also, we further reduced our non-compensation expenses. We were The volatile environment in the second half of the year had a significant impact on public market valuations for financial services firms, and our common stock, like others’ in the industry, traded at historically low levels relative to book value. This depressed valuation placed significant pressure on our goodwill impairment testing as market capitalization is a key determinant of possible goodwill impairment, and during our annual impairment testing for 2011, we determined that an The following are more specific financial highlights for the year: We generated revenues of $458.1 million, down from $530.1 million in 2010, which was our highest level of revenues since becoming a public company. We incurred a net loss of $102.0 million on a GAAP basis; excluding the $118.4 million after-tax goodwill impairment charge, we generated non-GAAP net income of $16.4 million for the year. Net income was $24.4 million for 2010, which included $10.9 million of pre-tax restructuring charges primarily related to our European operations. Investment banking revenues declined 21.2% to $212.9 million, compared to $270.1 million in 2010. Debt financing revenues decreased to $54.6 million, compared with $66.0 million in 2010. Our public finance investment banking business was negatively impacted by concerns over Institutional brokerage revenues declined 9.6% to $168.2 million, compared to $186.0 million in 2010. Asset management revenue increased 5.9% to $71.2 million, compared to $67.2 million in 2010, due to the recognition of a full year of management fee revenue from Advisory Research, which was acquired in March 2010, offset by lower performance fees. We Overview of 2011 Compensation Throughout this proxy statement, we refer to our chief executive officer, The most significant actions taken in 2011 with respect to our named executive officers’ were significant reductions in year-over-year incentives. The annual incentive program for each executive officer, other than our general counsel, is funded solely from a measure of pre-tax operating income. (The annual incentive for our general counsel is 50% based on profitability, rather than 100% as is the case for other named executive officers.) These incentive pools decreased along with our profitability for the year, consistent with the discussion of our financial performance above. As a result, year-over-year annual incentives declined as follows: 65% decline for our chief executive officer, with his annual incentive decreasing to $702,000 from $1,991,667 in 2010; 79% decline for our chief financial officer, with her annual incentive decreasing to $75,000 from $358,333 in 2010; 88% decline for our former president and chief operating officer, with his annual incentive decreasing to $200,000 from $1,691,667 in 2010; 46% decline for our head of 36% decline for our general The effect of these Our executive compensation program is designed to drive and reward corporate performance annually and over the long term, as measured by increasing shareholder value. Compensation also must be internally equitable and externally competitive. Pay for Align risk and reward through a blend of pay components — We are committed to using a mix of compensation components — base salary, annual incentives and long-term incentives — to create an environment that encourages increased profitability for the company without undue risk taking. Align employees with shareholders — We are committed to using our compensation program to increase executive stock ownership over time. Setting Compensation The Compensation Committee, compensation that may be paid under the annual incentive program (as described below under “Compensation Program and Payouts — Involvement of Executive Officers The work of the Committee is supported by our Compensation Peer Group Our human capital department, in consultation with We also use data from external market surveys reflecting a broad number of firms within our industry (including members of our peer group), and we may review publicly available data for similar companies that are not direct Compensation Consultant The Committee engaged Frederic W. Cook & Co., Inc. (“FWC”) as its independent compensation consultant as of May 2011. FWC is independent of the Company’s management, reports directly to the Committee, and has no economic relationships with the Company other than its role advising the Committee. The Committee considers advice and recommendations received from FWC in making executive compensation decisions. Prior to the engagement of FWC, the Committee had engaged Towers Watson as its independent compensation consultant during 2011 to provide executive compensation advice at Committee meetings. Towers Watson also provided benefit plan services to our human capital department, including health and group benefit services (e.g., medical and dental cost analysis) and retiree medical actuarial services. These additional services were pre-approved by the Compensation Committee in early 2011, and the amount we paid for these services did not exceed $120,000. Say-on-Pay At our 2011 annual meeting of shareholders, our say-on-pay proposal received “for” votes that represented 82% of the votes cast. The Committee considered the results of the 2011 say-on-pay vote when evaluating our compensation practices and policies in 2011 and when setting the compensation of our named executive officers Compensation Program and The key components of our executive compensation program are base salary and annual incentive compensation, and the equity portion of our annual incentive compensation The purpose of base salary is to provide a set amount of cash compensation for each executive that is not variable in nature and is generally competitive with Annual Incentive Compensation Delivering a significant portion of our compensation through annual incentives reflects one of the 2011 Program At the The amount With respect to the elimination of the goodwill impairment, the losses from this impairment principally related to the low public market valuations for financial services firms, as discussed above, and not any specific actions taken by the named executive officers during the year that affected operating performance. Accordingly, we believe that eliminating this goodwill impairment charge, in accordance with the formula established at the outset of the year, more accurately reflects our operating performance for the year. As to the two components, we eliminated the entire $105.5 million pre-tax goodwill impairment charge created from the 1998 acquisition of our under the formula for pre-tax operating income because this component of goodwill related to acquisitions undertaken by management following our In Net income/(loss) Removal of net income applicable to noncontrolling interests Income tax expense Expense under our annual incentive program Amortization expense for equity awards granted in connection with acquisitions Goodwill impairment charge (U.S. Bancorp-related) Goodwill impairment charge (other) Adjusted pre-tax operating income Mr. Chosy’s annual incentive is discretionary and based on a percentage of salaries for corporate support leaders and full-firm profitability. For 2011, 50% of his annual incentive was based on full-firm profitability. The Committee believes his annual incentive compensation should be less dependent on our performance than the other named executive officers, who have a greater ability to affect our performance. Compensation Determinations and Relevant Factors When determining the amount of incentive compensation to be paid for 2011, the Committee reviewed and considered the following information: for the chief executive officer, a self-evaluation, a performance review with input from his direct reports, and feedback from the full Board of Directors, gathered by the Committee chairperson, regarding performance for 2011; performance evaluations of each other named executive officer prepared by the chief executive officer and the head of our human capital department; the financial performance of the peer group financial and compensation data, including total shareholder return for the compensation market data provided by our human capital department; the recommendations of the chief executive officer regarding the incentive compensation to be paid to each executive officer for 2011, which the Committee discussed with the chief executive officer; and tally sheets specifying each element of compensation paid to the executive officers for the current and prior year and reflecting the total proposed compensation for 2011 based on the recommendations of the chief executive officer, as well as the potential compensation to be received by the executive officers under various scenarios, including a change-in-control of the company and terminations of employment under a variety of circumstances. In determining the payments made to our named executive officers, the Committee took into account all of the information described above and the annual incentive program provision governing the maximum aggregate amount payable under the qualified performance-based awards granted to our named executive officers other than Mr. Chosy. The Committee considers all of the factors described above in exercising its discretion to determine the annual incentive compensation paid to each named executive officer. For executives responsible for a business unit, payouts were impacted by the financial performance of their business unit. Our chief executive officer’s incentive was impacted by the operating performance of public finance and fixed income, as to which he had primary operational responsibility for the year. Also, our former president and chief operating Andrew S. Duff, chairman and chief executive officer. Mr. Duff’s compensation was primarily influenced by our decline in profitability for 2011 compared to our strong performance in 2010, with a 65% year-over-year decline in incentives. The decline in profitability was mitigated somewhat by progress against our strategic initiatives, which focus on increasing the proportion of higher margin businesses that include public finance, asset management, and merger and acquisition advisory engagements. As to business unit performance, our public finance business continued to build a national franchise and achieved strong relative results, including market share gains for 2011. As to fixed income, revenues were only down slightly in a volatile macroeconomic second half of the year that experienced widening credit spreads in a low interest rate environment. Debbra L. Schoneman, chief financial officer. Ms. Schoneman’s compensation was also influenced by our decline in financial performance for 2011, with a 79% decline in year-over-year incentives. Her efforts to reduce year-over-year non-compensation expenses and our related quarterly run-rate for these expenses, as well as her continued efforts to improve our financial planning and risk management functions during 2011, positively influenced her compensation for the year. James L. Chosy, general counsel and secretary. Mr. Chosy’s compensation reflected his efforts to strengthen our global compliance structure, drive our focus on ethics, and successfully manage legal expenses, which the Committee considered favorably when evaluating his 2011 performance. Brien M. O’Brien, head of asset management. Mr. O’Brien’s compensation was influenced by the stable performance of our asset management business for 2011 compared to our other business lines. His efforts successfully integrating Advisory Research as well as his overall leadership of our asset management segment, which we view as a significant part of our long-term strategy, also positively impacted his 2011 compensation. Thomas P. Schnettler, former president and chief operating officer. Mr. Schnettler’s compensation was primarily influenced by the decline in performance of our equity investment banking and institutional brokerage businesses compared to 2010, and in particular the loss we incurred in our Asia operations. Countering this negative performance was our positive relative performance within the U.S. and European markets in which we operate. Consistent with our pay-for-performance philosophy, this overall decline in performance caused the incentive compensation awarded to him for 2011 to decrease 88% from $1,691,667 for 2010 to $200,000 for 2011. Based on this information, the Committee evaluated the performance of The table below shows the annual incentive awards that were earned by each individual in 2011. This supplemental table differs from the Supplemental Compensation Table Name Andrew S. Duff Debbra L. Schoneman James L. Chosy Brien M. O’Brien Thomas P. Schnettler Equity Awards Consistent with our philosophy regarding executive stock ownership, the annual incentive compensation for the named executive officers was paid out in a combination of cash and equity. Our equity awards each year are not in addition to other incentive amounts. Rather, we calculate a total annual incentive, then divide that amount between cash and equity. Since 2009, we have granted equity awards to our executive officers in the form of restricted stock. We believe restricted stock awards strongly align the executive officers’ interests with those of shareholders by ensuring that the same fluctuations in our stock that affect our shareholders also directly affect the value of the awards granted to executive officers. In 2012, the Committee intends to further consider potential long-term incentives in the form of equity to facilitate increased alignment of the interests of our stockholders and management and foster long-term shareholder valuation creation. In determining the allocation between cash and equity, the Committee, together with the Nominating and Governance Committee, reviews the executive officer compensation process, which includes a review of the allocation for the prior year. The Committee also reviews the compensation mix between cash and equity for executives as part of its regular strategic review of executive compensation programs. This is to ensure the programs will incentivize executives to focus on firm-wide, long-term value creation for shareholders. Accordingly, the executives who are viewed to have the greatest ability to influence long-term, firm-wide results receive the largest allocation of equity within the company. In establishing the allocation between cash and equity, the Committee may consider historic practice, current equity ownership levels, input from its independent compensation consultant on current market practices, and the role of equity in overall executive compensation program design. The annual incentive compensation for our chief executive officer historically has been divided equally between cash and equity, as seen above in the Supplemental Compensation Table. Our executive officers, other than the chief executive officer and head of asset management, historically have received between 40% to 45% of their annual incentive compensation in equity and 55% and 60% in cash. Mr. O’Brien has not received equity as a part of his incentive compensation. He received a significant ownership stake in the company as part of our acquisition of Advisory Research, and currently holds 335,199 shares, 1.72% of our outstanding common stock as of February 17, 2012. Given his significant equity ownership in our company, the Committee believes his interests already are significantly aligned with our shareholders and cash is a more appropriate form of compensation for him. Lastly, the number of shares of restricted stock granted to each officer was determined by dividing the total dollar value designated to be paid out to the officer in restricted stock by the closing price of our common stock on February 15, 2012. The restricted stock vests in three equal annual installments. Recent Developments Effective as of January 1, 2012, we entered into an employment agreement with Brien O’Brien, our Head of Asset Management. The agreement has a three-year term, and provides for a base salary and that we will make quarterly cash payments to Mr. O’Brien equal to 11% of the earnings before interest, taxes, depreciation and amortization (EBITDA) of our asset management business for the preceding quarter. This EBITDA calculation also excludes the impact of Mr. O’Brien’s compensation, corporate overhead allocations, certain extraordinary costs related to Fiduciary Asset Management (FAMCO), and gains or losses on investments we make in funds of our asset management business. Applying the calculation to Mr. O’Brien in 2011 would have resulted in adjusted EBITDA for the year of $32.4 million. In addition to the quarterly payments, the agreement provides for annual payments to Mr. O’Brien if the asset management business exceeds EBITDA performance thresholds for the year as follows: Annual Asset Management EBITDA Additional % of Asset Management EBITDA Payable Accordingly, the variable component of Mr. O’Brien’s compensation pursuant to his employment agreement is dependent upon the profitability of our asset management business, for which he is primarily responsible. We entered into this agreement with Mr. O’Brien in recognition of the strategic importance of sustaining and growing our asset management operations over the long term. Another change for 2012 was the adoption by the Committee of the Piper Jaffray Companies Mutual Fund Restricted Shares Investment Plan (the “MFRS Plan”) in February 2012. The MFRS Plan allows recipients of restricted stock of the company to instead elect to receive 10% to 50% of their equity grant in the form of restricted shares of selected mutual funds managed by our affiliates, Advisory Research or FAMCO. The mutual fund restricted shares have the same restrictions that would apply to restricted stock, and also vest ratably over three years. We adopted the MFRS Plan to provide our executives an opportunity to diversify the equity compensation they receive, and believe the plan will help us attract and retain top talent. It also capitalizes on the strength of our asset management business by allowing us to offer a compensation plan that most of our competitors cannot provide. For the current year, none of our named executive officers participated in this plan, though we expect in future years that one or more executive officers may participate. In May 2008, the Committee granted a long-term, performance-based restricted stock award to our executive officers at that time, which will not vest unless the Other Compensation Our executives receive only limited perquisites, as illustrated in Some of our We do not have any separate change-in-control agreements (often referred to as “golden parachute” arrangements) that would pay a Under our Incentive Plan, following a termination of employment (other than as a result of a change-in-control), our stock option awards granted during and after 2007 and our restricted stock Executive officers who are terminated during the year (other than as a result of a change-in-control) will receive cash and equity compensation for that year under our annual incentive program in the discretion of the Committee. Compensation Policies Executive Stock Ownership We have adopted stock Equity Grant Timing Policy In 2006, we established a policy pursuant to which equity grants to employees will be made only once each quarter, on the Section 162(m) of the Internal Revenue Code limits deductions for non-performance-based annual compensation in excess of $1 million paid to our named executive officers who served as executive officers at the end of the preceding fiscal year. Our policy is to maximize the tax deductibility of compensation paid to these officers. Accordingly, in 2004, 2006, and 2008 we sought and obtained shareholder approval for the Piper Jaffray Companies Amended and Restated 2003 Annual and Long-Term Incentive Plan, under which our annual incentive program is administered and annual cash and equity incentives are paid. The This Compensation Discussion and Analysis includes the use of The Committee has reviewed and discussed the Compensation Discussion and Analysis with management and has recommended to the Board of Directors the inclusion of the Compensation Discussion and Analysis in the company’s year-end disclosure documents. Compensation Committee of the Board of Directors of Piper Jaffray Companies Michele Volpi,Chairperson Lisa K. Polsky Frank L. Sims The following table contains compensation information for our chief executive officer, our chief financial officer, and our three other most highly compensated executive officers. Andrew S. Duff Chairman and CEO 2010 2009 608,333 400,000 995,834 1,200,000 1,200,000 — 11,691 11,691 2,815,858 1,611,691 Debbra L. Schoneman Chief Financial Officer 2010 2009 391,667 225,000 215,000 315,000 210,000 — 6,768 6,963 823,435 546,963 James L. Chosy General Counsel and Secretary( 2010 391,667 128,000 170,000 11,253 700,920 Brien M. O’Brien Head of Asset Management(4) 2010 354,167 3,525,398 — 144,082 4,023,647 Thomas P. Schnettler Former President and Chief Operating Officer 2010 2009 508,333 300,000 930,417 1,155,000 945,000 — 9,270 27,750 2,393,020 1,482,750 The amounts in this column include the cash compensation paid under our annual incentive The entries in the All other compensation consists of the following: Form of All Other Compensation ($) Club membership dues 2010 2009 4,494 4,494 — — 4,200 n/a 20,669 n/a — — 401(k) matching contributions 2010 2009 6,408 6,408 6,408 6,408 6,408 n/a 6,408 n/a 6,408 6,408 Life and long-term disability insurance premiums 2010 2009 789 789 360 555 645 n/a 78,994 n/a 789 789 Automobile lease payments 2010 2009 — — — — — n/a 34,111 n/a — — Other 2010 2009 — — — — — n/a 3,900 n/a 2,073 20,553 Amount for “Club membership dues” for Messrs. Chosy and Duff in 2011 consisted for annual dues for a Minneapolis-based club membership, and the amounts for Mr. O’Brien in 2010 were provided pursuant to a now-expired letter agreement entered into as part of our acquisition of Advisory Research, Inc. The “Other” amounts identified in the table above Messrs. The following table provides information regarding the grants of plan-based awards made to the named executive officers during the year ended December 31, Name Andrew S. Duff Debbra L. Schoneman James L. Chosy Brien M. O’Brien Thomas P. Schnettler The Compensation Committee approved a grant of stock The amount in The The following table sets forth certain information concerning equity awards held by the named executive officers that were outstanding as of December 31, Name Andrew S. Duff Debbra L. Schoneman James L. Chosy Brien M. O’Brien Thomas P. Schnettler The shares of restricted stock vest on the dates and in the amounts set forth in the table below, so long as the award recipient complies with the terms and conditions of the applicable award agreement.• FORall of the nominees for director; and• FORthe amendment to the Incentive Plan to increase the number of shares of our common stock available for issuance under the Incentive Plan by 1,500,000 shares. The Board of Directors believes that this proposal is critical to Piper Jaffray’s future success, so please vote your shares, or instruct your broker, bank, trust or other nominee to vote FOR this proposal.• FORall of the nominees for director; and• FORthe amendment to the Incentive Plan.3FOR all of the nominees for director;